Disclaimer: I was compensated for my time in exchange for my honest review.

What does your Tween or Teen know about Finance? As parents, tackling financial literacy with our kids is a life skill that can’t be ignored because most of us learned the hard way after leaving home. I’m determined to make sure my children are better prepared for adulthood. We’re using Before Personal Finance.

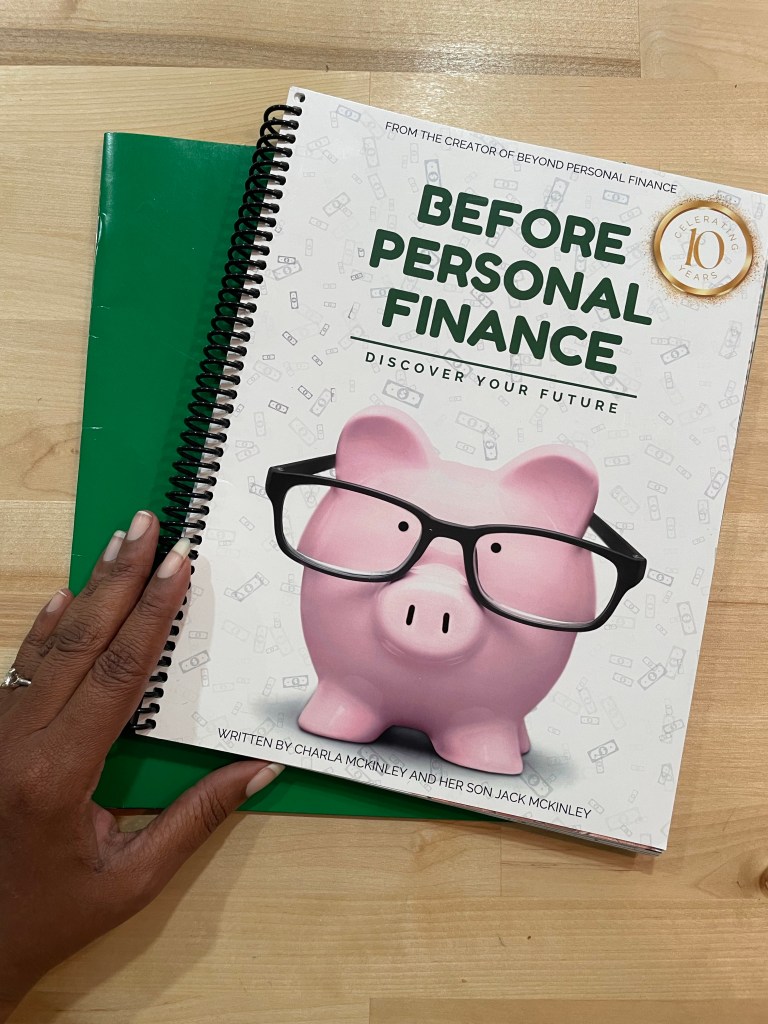

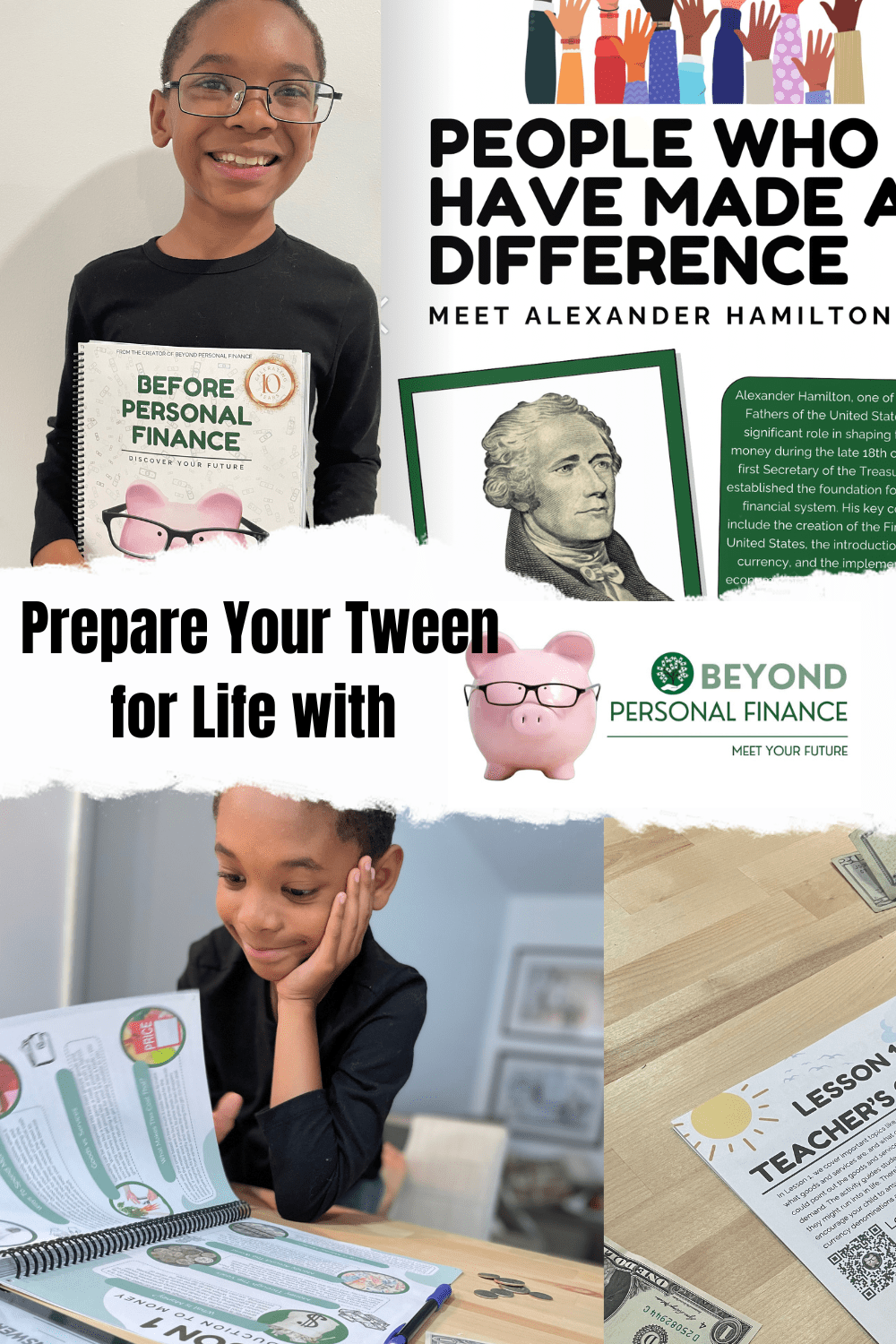

Before Personal Finance, written by Charla and Jack McKinley, is a financial literacy course made for Tweens 8-12, to introduce real life concepts surrounding money. Broken down into 10 easy to digest lessons, covering one lesson per week, Before Personal Finance can be seamlessly added to any homeschool schedule, after school learning, or summer break to help parents teach what can be a difficult but needful subject. With this curriculum you get an all-in-one teachers guide, textbook and workbook and access to additional online resources located at QR Codes found in your book.

During the 10 week course you’ll cover:

- Introduction to Money

- Earning Money

- Budgeting

- Smart Spending

- Generosity

- Borrowing Money

- Governments and Money

- Banks

- Investing

- Insurance

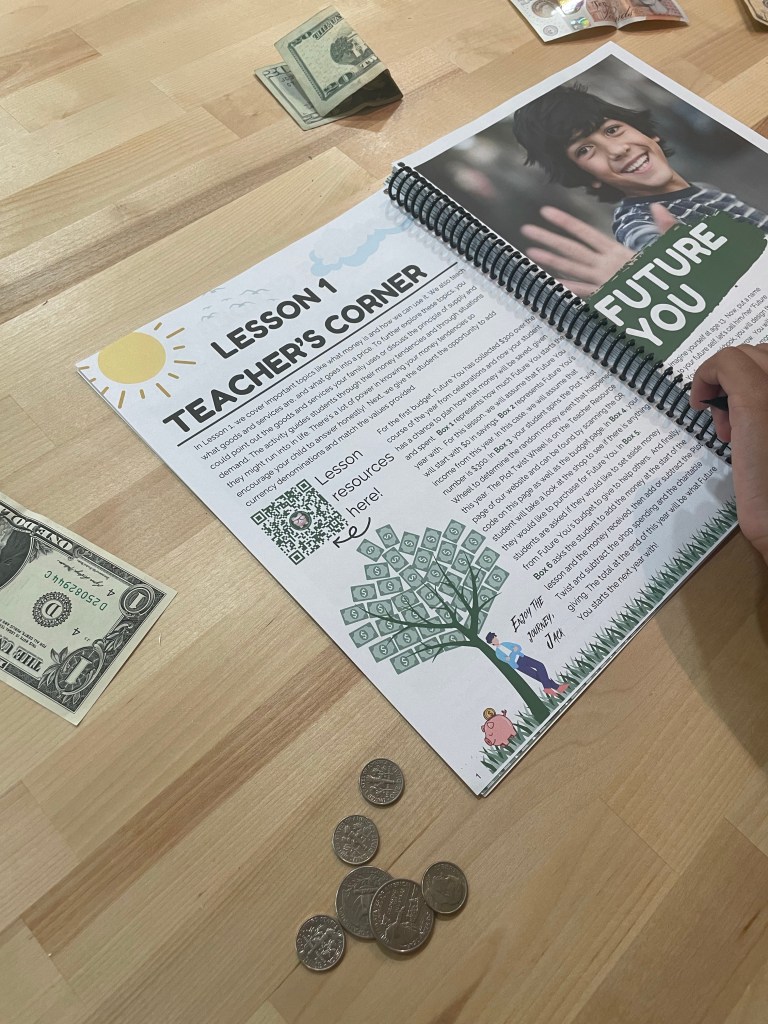

In Before Personal Finance, each lesson is broken down into 4 primary sections – Teaching, Activity, Budget, and a 10 question Quiz for review. You’ll find an estimated time for completing each area of the lesson, which averages about 2 -2.5 hours spent with the course for each of the 10 weeks. We choose to spend an hour work on the course for 2 days, usually Sunday and Wednesday, and split the work in half. Your guide is in full color with large text, photos, and illustrations and is simple to follow. Use the consumable, spiral bound pages OR make additional copies to keep your guide pristine.

How we used Before Personal Finance

For my family, Before Personal Finance is a supplement in our homeschooling that is an excellent companion to our math course but fits right into our summer life skills focus. Even if the interest is only on money your kid likes to spend, this applied learning course lets them see the everyday impact their choices can have on their lives and their future. One of my favorite parts of the course was imagining your child’s “ Future You”. “Future You” looks at their likes/wants/needs and plots a financial “Choose Your Own Adventure” type story for them starting at age 13 and continuing until their 20’s as the lessons progress. Needs and wants may start with toys but progress at the appropriate times to needing a car or even housing. Each chapter and lesson they plan for being a little older and the finances get a little more complex. This practice now makes good financial choices easier in the future.

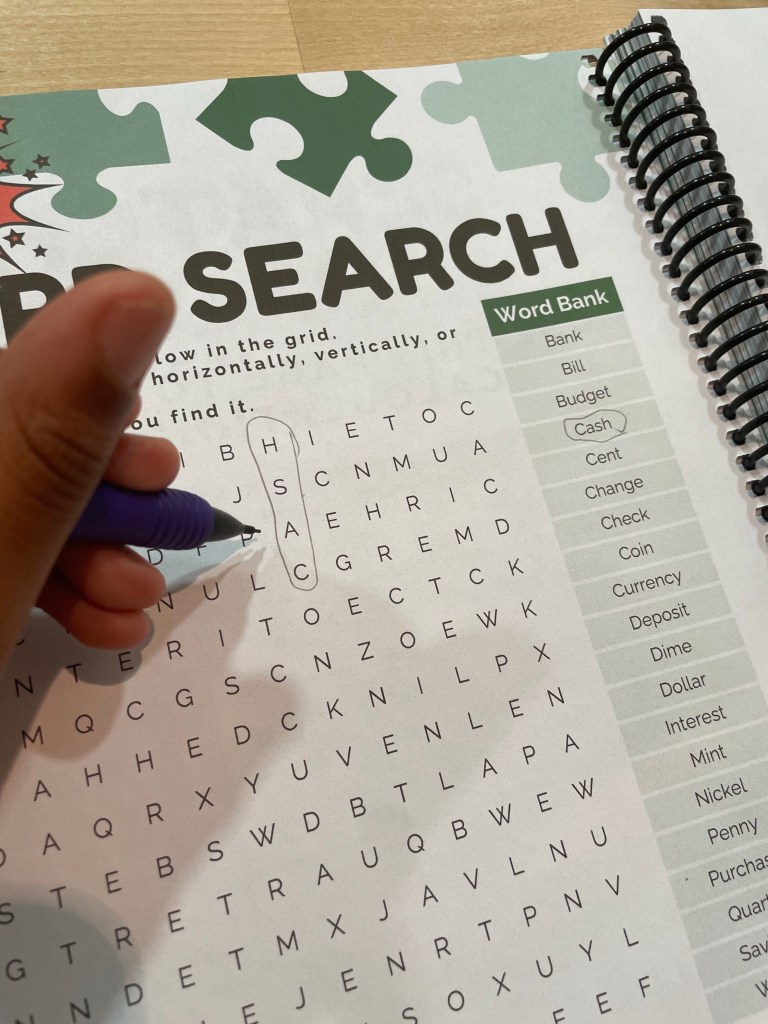

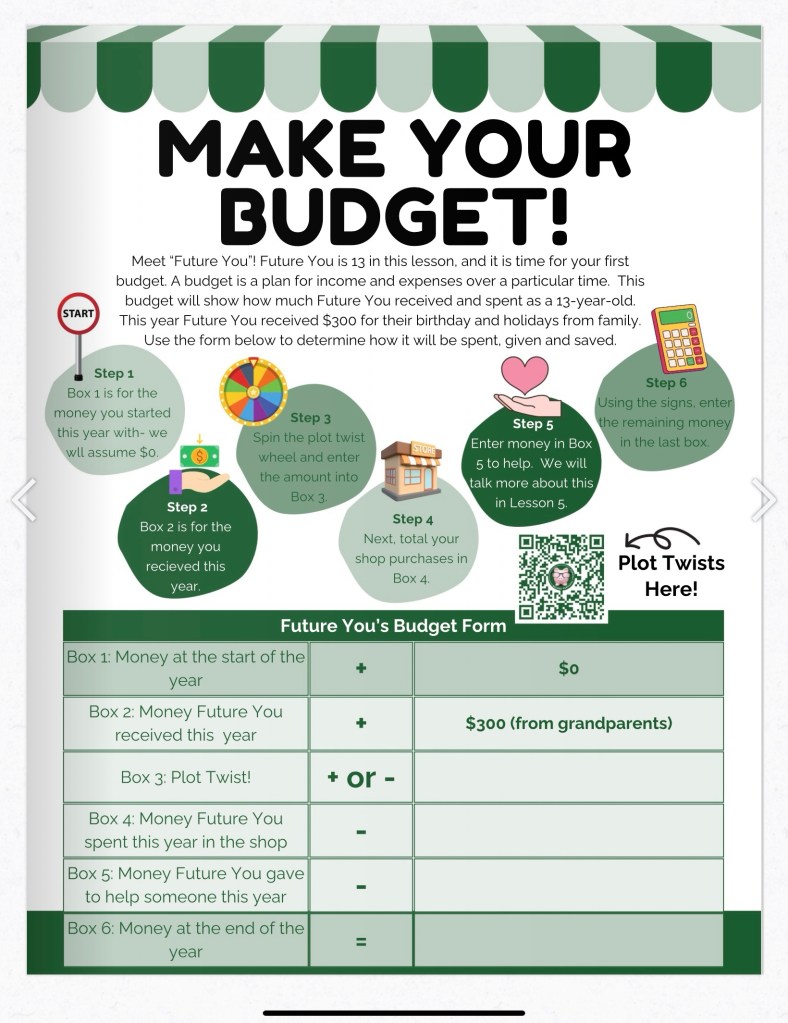

Cash got to choose how he spent his money (Spoiler alert – he buys books and toys), and makes a budget for himself using actual scenarios with real life problems as determined by his online wheel of fortune called a plot twist wheel. There are also extension activities including word searches, financial vocabulary, along with history and notable biographies of people in finance. Best of all, each lesson concludes with reflection on what was learned as well as a chance to dive deeper with your child about how they feel about the financial decisions they are making.

There isn’t anything presented in Before Personal Finance that you’ll find too difficult to understand. It’s written in plain language with new vocabulary explained in the Key Terms section in the back of the guide. Even though the curriculum is for Tweens I could easily see Before Personal Finance adapted by the parent for a younger learner. It’s meant to be flexible and easy to use for practical application that will give your learner the foundation they need for more in-depth financial conversations in the future.

Having a kid whose legal name is “Cash” means that my son really enjoys learning about money. We’ve used various financial literacy books and games in the past, but Before Personal Finance really made an impression on him and I can’t wait to continue the learning with BEYOND Personal Finance also by Charla McKinley. It’s a more in depth study for teens with included video lessons and online access to their Teacher and Student portal for a year.

Think this may be a need in your home as well? Check out more about Before Personal Finance AND Beyond Personal Finance on their website at www.beyondpersonalfinance.com

Leave a comment